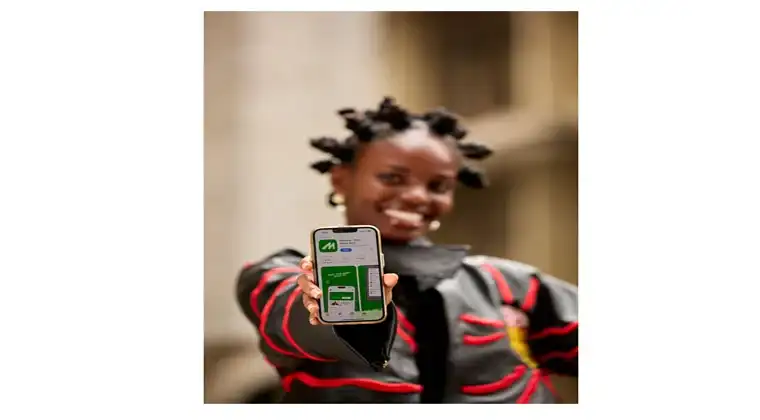

In a country where millions search daily for how to sell bitcoin in Nigeria or check the bitcoin to naira rate today, speed and trust have become essential. Monica Cash has now surpassed 500 billion naira in total transactions, marking three years of sustained growth and reinforcing its reputation as one of the leading crypto finance platforms in Nigeria.

Over the past three years, Monica Cash has expanded from a focused crypto conversion tool into a broader digital finance application serving more than 500,000 registered users nationwide. Initially known for enabling fast bitcoin to naira and USDT to naira conversions, the platform has steadily evolved to meet wider everyday financial needs.

Many users first joined during periods of market volatility, seeking quick and reliable crypto withdrawals. Retention, however, has been driven by consistent payout speed, transparent exchange rates, and a simplified user interface. As customers experienced dependable settlements, referrals and organic growth followed.

According to the Founder, the long term goal was always larger than crypto exchange alone. The platform now allows users to purchase airtime and data, pay electricity and cable bills, access digital gift cards, and transfer funds instantly to more than 30 Nigerian banks. This diversification positions Monica Cash as an integrated digital payment ecosystem rather than solely a trading application.

The company reports processing over 350 million dollars in crypto conversions, supported by strong liquidity management and rapid transaction execution. Security measures such as biometric login, encrypted processing, and structured monitoring systems further strengthen user confidence.

Crossing the 500 billion naira milestone reflects scale, operational consistency, and growing consumer trust within Nigeria evolving digital finance landscape.

Leave a comment