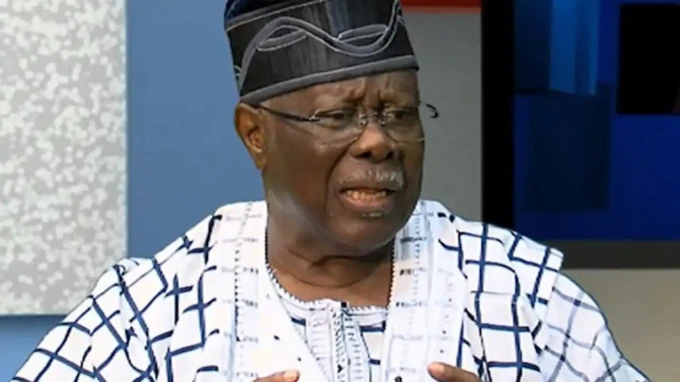

Nigeria’s wealthiest citizens will see their Personal Income Tax (PIT) rate rise to 25% beginning next year. Mr. Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, made the announcement at the ongoing #NES30 conference in Abuja.

As a panelist in a session titled “Fiscal and Monetary Policy Reforms: Removing Barriers to Private Sector Investment,” Mr. Oyedele elaborated on the tax reforms currently under review by the National Assembly. The proposed laws, once approved, will be implemented in January 2025, aiming to reduce the tax burden on low-income earners while increasing taxes for the wealthiest individuals.

“Many people don’t like to pay taxes, but they often fail to realize that those taxes will eventually benefit them,” Oyedele stated. He highlighted the government’s deliberate efforts to ease the tax load on businesses. “For instance, today, whatever VAT you pay on assets—whether you’re building a factory, purchasing a laptop, or buying vehicles—is borne entirely by the business. This increases your costs, which in turn raises prices. However, with our reforms, you will receive a 100% credit on services and assets.”

Oyedele also emphasized that corporate income tax rates would be reduced from 30% to 25%, marking a significant change. He explained, “These bills are currently with the National Assembly, and we plan to implement them from January 2025.”

On the subject of personal income tax, Oyedele noted that the reforms are structured to benefit different income groups fairly. “Those in this room may not appreciate this because there are wealthy individuals present. If you earn 1.5 million naira a month, your personal income tax bill will decrease. Those at the lower end will be completely exempt. However, for those earning more, the rate will increase incrementally, reaching 25% for the highest earners.”

The announcement underscores the Nigerian government’s strategy to create a more balanced and equitable tax system. By easing the tax burden on low-income earners and businesses, while ensuring that high earners contribute more, the reforms aim to stimulate economic growth and enhance social welfare. With the proposed changes set to take effect in 2025, all eyes are on the National Assembly as they review the bills and work towards passing them.

I dont see the big deal. If theyre wealthy, they can afford it! Time to redistribute the wealth, am I right?

I think its about time the wealthy start paying their fair share. Lets see some real change in Nigeria!

I think the wealthy should pay even more! 25% is too low considering the income disparity in Nigeria. Lets aim higher!

This is outrageous! Why should the wealthy be punished for their success? Let them keep their hard-earned money.

Wealthy already benefit from a system that favors them. Time for fair taxation.

Is it fair to tax the wealthiest individuals at a higher rate? Lets discuss the implications and potential consequences.

I dont see why the wealthy should pay more taxes. They already contribute a lot to the economy. #TaxDebate

The wealthy benefit the most from society; its fair they contribute more. #TaxEquality

I dont think its fair to target the wealthy with a higher tax rate. Everyone should pay their fair share!

I dont get why theyre only implementing this in 2025. We need tax reform now! Its long overdue.

I dont get why the wealthy are complaining about a 25% tax rate. They can afford it! Time to give back.

This is outrageous! Why should the wealthy be taxed more? They already contribute so much to the economy. #TaxTheRichDebate

Why should the wealthy be taxed more? They already contribute a lot to the economy. This seems unfair.

The wealthy have more to spare. Fairness is about equality, not favoring the rich.

Wow, 25% income tax for Nigerias wealthiest? Its about time they contribute more to society! What do you all think?

I think the 25% personal income tax rate for Nigerias wealthiest is fair. They should contribute more to the countrys development.

I believe this tax increase will help redistribute wealth in Nigeria. Its time the wealthy contribute more to society.

I think its fair for the wealthy in Nigeria to face a 25% income tax rate. They should contribute more to society.

Wow, 25% tax rate on Nigerias wealthiest by 2025? Will this really help redistribute wealth or just drive the rich away? Discuss.

Seems like the rich in Nigeria will finally have to pay up! About time or too harsh? What do you think?

I dont think its fair to target the wealthiest with such a high tax rate. Everyone should pay their fair share.

Wow, 25% income tax for Nigerias wealthiest? Is this fair or too heavy a burden? Lets discuss!

Seems fair, but will this actually be enforced? Wealthy Nigerians might find loopholes to avoid it. Just saying.

Wow, 25% tax for Nigerias wealthiest? Is this fair or too harsh? Lets discuss! 💰🤔 #TaxDebate