The Kano Zonal Director of the Economic and Financial Crimes Commission (EFCC), Ibrahim Shazali, has issued a stern warning to travellers, including businessmen, pilgrims, and tourists, about the severe consequences of violating Nigeria’s cash movement laws. Speaking at a sensitisation programme in Kano on April 26, 2025, Shazali emphasized that undeclared cash exceeding $10,000 risks permanent forfeiture, with offenders facing a minimum of two years imprisonment. The event, jointly organized by the Nigeria Customs Service (NCS), the Independent Corrupt Practices Commission (ICPC), and the EFCC, aimed to educate stakeholders on legal requirements for cash movement in and out of Nigeria.

Shazali highlighted Nigeria’s commitment to international anti-money laundering conventions, citing the Central Bank of Nigeria (CBN) Act, the Money Laundering (Prevention and Prohibition) Act 2022, and the EFCC Establishment Act as key frameworks governing cash declarations. “Despite these laws, many travellers still engage in illegal cash movements, either out of ignorance or deliberate attempts to evade financial regulations,” he said, stressing that ignorance is not an excuse and violators will face prosecution.

Under Nigerian law, travellers carrying $10,000 or its equivalent in any currency must declare it to the NCS at entry or exit points and provide evidence of the funds’ legitimate source, such as bank withdrawal slips or financial records. Failure to comply is a criminal offence under Section 2 of the Money Laundering Act, with undeclared funds subject to seizure and permanent forfeiture to the Federal Government. Shazali also noted that high-value transactions should use electronic transfers for traceability, as mandated by the 2022 Money Laundering Act.

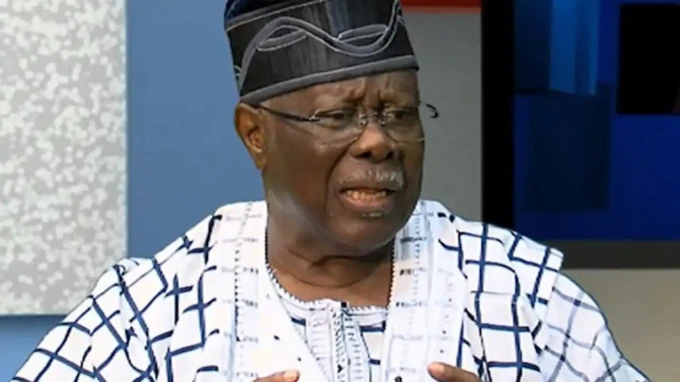

The EFCC, in collaboration with NCS and ICPC, has intensified airport surveillance to curb illicit financial flows. Offenders face arrest, detention, and prosecution under Section 13 of the EFCC Act, with convicted individuals risking at least two years in prison. Frequent violators may be blacklisted, facing travel restrictions, while businesses involved could lose banking privileges and public trust. “The consequences of illegal cash trafficking are grave—ranging from imprisonment, hefty fines, to forfeiture of assets,” Shazali warned, echoing sentiments from EFCC Chairman Ola Olukoyede, who spoke through Shazali at the event.

The sensitisation programme, themed “Illegal Cash Movement Through Nigerian Airports: Consequences, Legal Frameworks, and EFCC’s Enforcement Role,” brought together Bureau de Change operators, airline representatives, and the Kano State Pilgrims Welfare Board. Stakeholders like Alhaji Sani Dada, Kano State Chairman of Bureau de Change, praised the initiative, noting that undeclared currency seizures at airports often stem from ignorance. NCS Controller Dalhatu Abubakar reported interceptions in Lagos, Kano, Abuja, and Daura, urging travellers to declare funds to avoid confiscation.

Posts on X reflected public awareness, with @NigeriaStories and @vanguardngrnews highlighting the EFCC’s warning of forfeiture and imprisonment for non-compliance. The programme aligns with Nigeria’s broader efforts to strengthen its financial system, as evidenced by a recent EFCC investigation into a passenger caught with $578,000 for false declaration at Murtala Muhammed International Airport.

Shazali called for collective vigilance, urging stakeholders to prioritize compliance to safeguard Nigeria’s economic stability and combat money laundering, terrorism financing, and corruption. The initiative underscores the EFCC’s resolve to enforce regulations, particularly as Nigeria seeks to maintain its improved standing on the Financial Action Task Force’s monitoring list.

Seems harsh, but if it deters corruption, maybe its worth it? What do you think? 🤔 #EFCC #CashMovement

Is it fair for the EFCC to threaten travellers with imprisonment for carrying cash? Seems a bit extreme, dont you think?

I dont get it, why should I worry about carrying cash abroad? What if I just want to have some emergency money with me?

I get the need to combat illegal cash movements, but forfeiture and imprisonment seem harsh. What do you think?

I think the EFCC is being too harsh on travellers. What about legitimate reasons for carrying large amounts of cash?

Wow, do you think the EFCC is being too strict with this cash movement warning? Should people have more freedom?

I dont get why people risk moving illegal cash when the consequences are so severe. Is it worth it? #EFCC #TravelWarnings

I dont see why EFCC is making a big deal about cash movement. Let people travel with their money in peace!

Hmm, do you think the EFCC is being too harsh on travellers carrying cash? Or is it necessary to combat illegal activities?