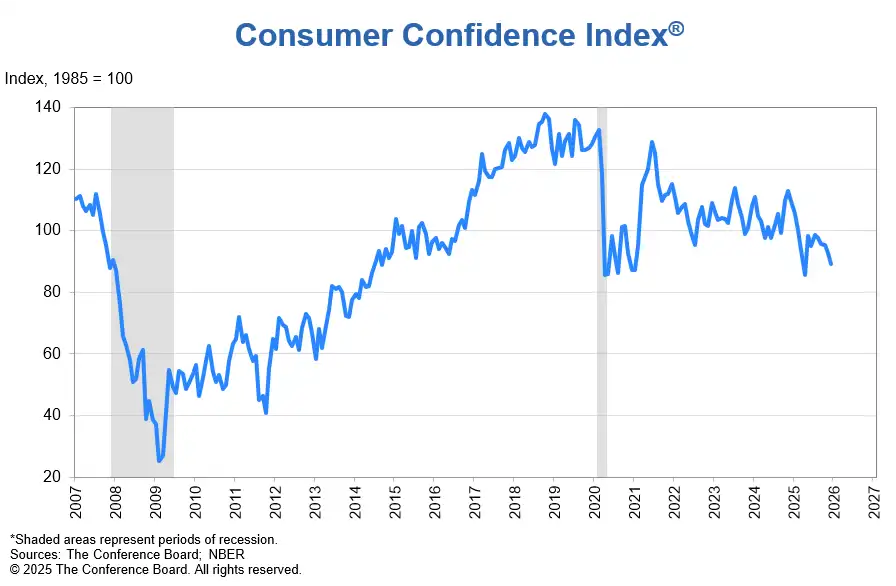

Recent economic indicators show a significant drop in the U.S. Consumer Price Index (CPI), suggesting forthcoming changes in Federal Reserve monetary policy. According to Truflation, the year-over-year inflation rate decreased to 1.955% on January 1, 2026, down from 2.7% in December 2025. This sharp decline has sparked renewed market speculation about interest rate cuts by the Federal Reserve in 2026.

The CME’s “FedWatch” tool indicates a 17.7% chance of a 25-basis-point rate cut in January 2026, while the probability of maintaining current rates stands at 85.1%. Additionally, the likelihood of a cumulative 50-basis-point cut by March is at 8.1%. Despite these expectations, the U.S. labor market remains stable, with robust jobs data and fiscal stimulus measures impacting the Federal Reserve’s policy outlook for the year.

The next Federal Open Market Committee (FOMC) meetings are set for January 28 and March 18, 2026, and market participants are keenly observing these dates for potential policy shifts. In summary, the notable decline in CPI alongside stable labor market conditions has led to heightened expectations for interest rate reductions by the Federal Reserve this year. Both investors and policymakers are closely monitoring these economic developments in the coming months.

- 2026As

- bolstered

- Consumer

- CPI

- data

- December

- decline

- Decreased

- drop

- Employment

- expectations

- federal

- Figures

- Fiscal

- Impacting

- Index

- inflation

- interest

- January

- Labor

- marked

- market

- measures

- notable

- Outlook

- Policy

- price

- Rate

- realtime

- Reductions

- remains

- Renewed

- Reserve

- Reserves

- Reveal

- robust

- service

- Shows

- significant

- sparked

- stimulus

- strong

- title

- tracking

- U.S

- YearOverYear

Im not convinced this drop in the Consumer Price Index is a good thing. What about the impact on wages?

Is this drop in the Consumer Price Index a sign of economic stability or a warning of impending recession? Lets discuss!

Seems like good news for our wallets, but could this drop in consumer prices indicate a larger economic issue looming? Thoughts?

I find it hard to believe the drop in the Consumer Price Index is a good sign. Something fishy is going on!

I find it hard to believe that the drop in the Consumer Price Index is accurate. Something fishy going on? 🤔

Wow, this drop in the CPI is interesting. Do you think its a sign of a strengthening economy or just a temporary blip? Lets discuss!