The Customs and Excise Division of Antigua and Barbuda has reported a significant increase in revenue collection for the first four months of 2025, marking a 9.3% rise compared to the same period in 2024. As of April 2025, the division collected over EC$173.4 million, surpassing the EC$158.6 million collected by April 2024. This positive trend continued into May, with receipts exceeding EC$200 million by May 20, 2025.

Comptroller of Customs, Raju Boddu, attributed this growth to enhanced enforcement measures and improved compliance within the trade sector. He noted that despite a slight decline in the total value of imports, the division’s efficient collection methods have led to better tax yields, with the yield increasing from 19.5% to 21.1% year-on-year.

The division’s success is also reflected in its performance in 2024, where it exceeded its revenue target by collecting over $502 million, marking a historic milestone by crossing the half-billion-dollar threshold. This achievement was attributed to a 25% growth in collections throughout the year.

Looking ahead, the division is implementing strategic initiatives to sustain and further enhance revenue collection. A key development is the formation of a Customs private sector group aimed at addressing cross-border trade issues and other Customs-related matters. This collaborative approach reflects a significant shift in the department’s engagement with stakeholders, recognizing the private sector’s substantial role in Customs-related business.

Additionally, the division is advancing its electronic single-window system initiative, following a diagnostic study by the World Customs Organization team in 2024. This modernization effort aims to streamline services, allowing clients to file returns and entries, make payments, and obtain licenses electronically from various authorities, thereby enhancing efficiency and reducing opportunities for evasion.

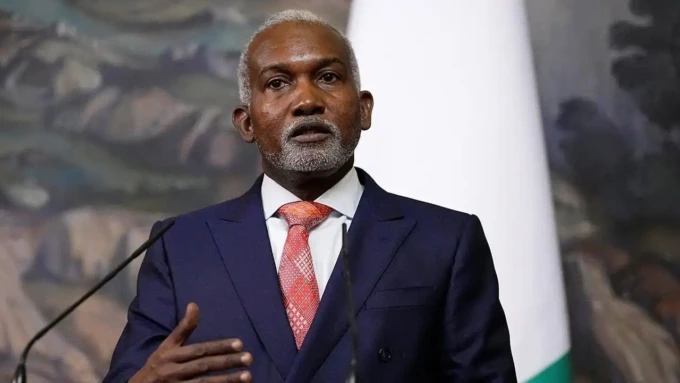

These measures align with the government’s broader fiscal strategy, which emphasizes strengthening tax compliance and collection without introducing new taxes. Prime Minister Gaston Browne has declared 2025 as the “Year of Compliance,” focusing on improving adherence to existing tax obligations to fund essential services and development projects.

The International Monetary Fund (IMF) has also recommended the establishment of a single-window system at Customs to streamline operations and enhance efficiency in tax administration. This recommendation underscores the importance of modernizing tax collection systems to boost domestic revenue mobilization without resorting to new personal income taxes or increasing the Antigua and Barbuda Sales Tax (ABST) rates.

Overall, the Customs and Excise Division’s proactive measures and strategic initiatives have contributed to a robust increase in revenue collection, reflecting a positive trajectory for Antigua and Barbuda’s fiscal health in 2025.

Wow, impressive revenue increase for Antigua and Barbuda! Do you think this trend will continue throughout the year? Exciting stuff!

Wow, impressive revenue increase! Could this mean better services or just higher taxes for us? What do you think?

Wow, thats impressive! I wonder if this increase is sustainable or just a short-term boost. What do you all think?

Hmm, I wonder if this increase in revenue is due to improved enforcement or just higher taxes. What do you all think?

I wonder if this revenue increase will lead to better public services or just more government spending. What do you think?

Wow, thats impressive! Do you think this increase is sustainable or just a temporary spike? Curious to hear your thoughts!

Wow, impressive revenue increase for Antigua and Barbuda! Do you think its due to better enforcement or economic growth? Lets discuss!

Do you think this increase in revenue is sustainable long-term or just a short-term spike? Curious to hear your thoughts!

I wonder if this increase in revenue is due to better enforcement or just higher taxes. What do you all think?

Wow, impressive revenue increase! But are they prioritizing sustainability over profit? Quality over quantity? Just a thought! 🤔