Emerging markets have demonstrated remarkable resilience amid a global economic slowdown, defying expectations and presenting promising investment opportunities across various sectors. Despite challenges such as elevated global interest rates and geopolitical tensions, these economies have maintained robust growth trajectories, underscoring their evolving strength and stability.

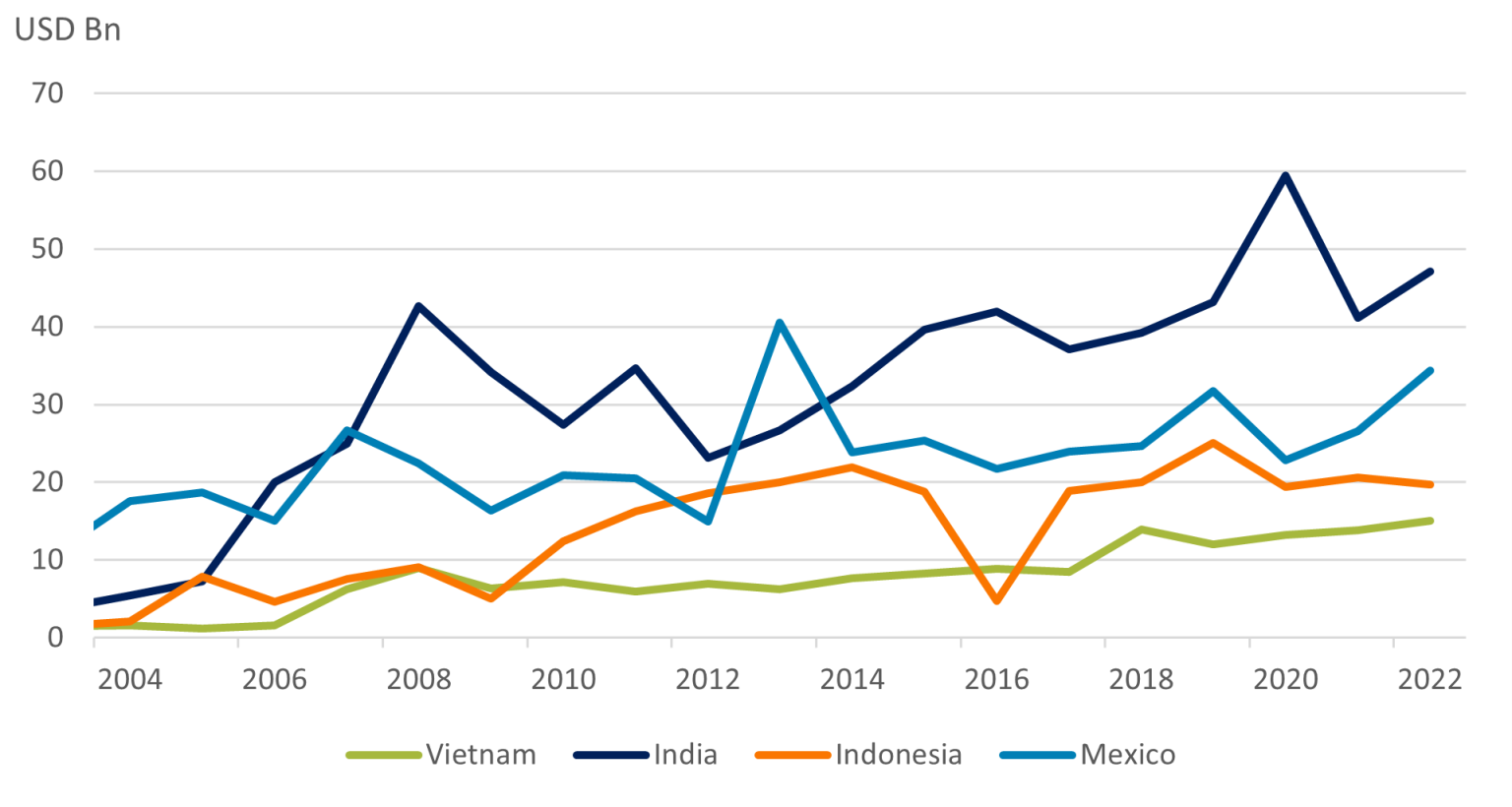

In 2023, emerging markets collectively achieved a growth rate of 4.0%, surpassing the 1.5% growth recorded by developed markets. This performance highlights the increasing economic vitality of these regions. Notably, Asia has been a significant contributor to this growth, with countries like India and Vietnam benefiting from shifts in global supply chains and increased foreign direct investment. India’s GDP growth of 7.8% in the second quarter of 2023 was driven by substantial infrastructure investments and a healthier financial system, fostering strong credit growth and robust services exports.

The resilience of emerging markets is further evidenced by the recovery of capital inflows. In 2023, net capital inflows into these economies, excluding China, rose to $110 billion, or 0.6% of GDP, marking the highest level since 2018. This trend indicates sustained investor confidence despite global monetary tightening and economic uncertainties.

Investment opportunities abound in key sectors within emerging markets. The technology and manufacturing industries, particularly in countries like Vietnam and Mexico, are poised for significant growth due to the relocation of supply chains and increased demand for diversified production bases. Vietnam’s exports to the U.S. have increased fourfold since 2013, positioning it as a major beneficiary of these global shifts.

Additionally, the services sector, including financial services and tourism, has shown robust expansion. For instance, Singapore’s financial services have attracted substantial foreign investment, while India’s burgeoning digital economy continues to draw global attention. The resilience of these sectors offers investors avenues for growth, especially as domestic consumption and infrastructure development continue to drive economic activity.

In conclusion, emerging markets have not only weathered the global economic slowdown but have also emerged as dynamic and resilient economies. Their diversified growth, coupled with strategic investments in key sectors, presents compelling opportunities for investors seeking to capitalize on the evolving global economic landscape.

Im not convinced that emerging markets will continue to thrive. Economic slowdowns can hit unexpectedly. Lets not get too comfortable.

Im not convinced about the investment opportunities in emerging markets. Seems risky with the global economic slowdown. What do you guys think?

Im not convinced. Emerging markets seem risky. Can we really trust these analysts investment recommendations? I have my doubts.

Im not convinced about investing in emerging markets. The risks seem too high, especially with the global economic slowdown.

Im not convinced about these investment opportunities in emerging markets. Seems risky with the global economic slowdown. Thoughts?

Im not convinced that emerging markets can sustain this resilience long-term. Economic slowdowns have a way of revealing vulnerabilities.

I believe investing in emerging markets is risky, despite their resilience. We should proceed with caution and not overlook potential pitfalls.

I think investing in emerging markets is risky, but could pay off big time. What do you guys think? Worth the gamble?

Im not convinced. Emerging markets might be resilient now, but can they sustain growth long-term? I have doubts.