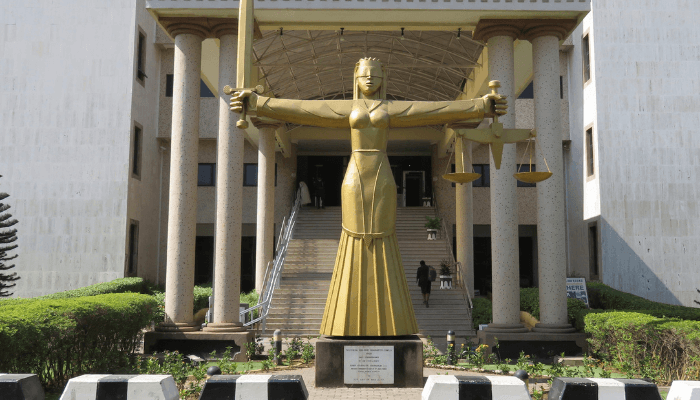

Justice Williams Aziegbemhin of the Benin High Court ordered the remand of Abubakar Musa, a self-proclaimed Bureau De Change operator, for allegedly converting €300,000 to his personal use. The judge directed that Musa be held in police custody in Benin for 14 days, pending the completion of ongoing investigations. The case, adjourned to May 19, 2025, for a hearing, stems from accusations that Musa defrauded a client by withholding funds intended for her family.

Police Prosecutor Polycap Odion told the court that Musa received €500,000 from a client to deliver to her family in Benin but only released €200,000, allegedly keeping the remaining €300,000. Odion, citing Sections 293, 294, and 296(1) of the Edo State Administration of Criminal Justice Law 2016, requested Musa’s remand to allow for a thorough investigation, arguing it would ensure justice under the court’s inherent jurisdiction. Justice Aziegbemhin granted the motion, emphasizing the need for diligent police work.

The incident aligns with a pattern of financial crimes in Edo State, where the Economic and Financial Crimes Commission (EFCC) has intensified efforts against fraud. For instance, on March 5, 2025, Aziegbemhin sentenced 24-year-old Emmanuel Esene to two years for internet fraud, ordering forfeiture of assets, per The Guardian. Musa’s case, however, involves a larger sum and direct misappropriation, raising concerns about trust in informal currency exchange systems. No official police statement has detailed the client’s identity or the exact date of the transaction, limiting clarity on the case’s scope.

Sentiment on X, reflected in posts like @MobilePunch’s report, expresses public frustration with financial scams, with users like @EdoWatch calling for stricter regulations on Bureau De Change operators. Critics, per Sahara Reporters’ 2024 coverage of similar cases, argue Nigeria’s porous financial oversight enables such fraud, with Edo’s proximity to international borders facilitating cross-border schemes. The 14-day remand aims to uncover whether Musa acted alone or as part of a syndicate, a common trait in Benin fraud cases, as seen in the EFCC’s March 2025 remand of seven for illegal petroleum lifting, also under Aziegbemhin’s gavel. As investigations proceed, the case underscores Nigeria’s broader challenge of curbing financial crimes amid economic pressures, with the naira’s volatility potentially driving illicit currency dealings.

Shouldnt the focus be on preventing such fraud rather than just punishing individuals after the fact? Lets discuss prevention strategies.

Do you think the courts decision was fair or harsh? Lets discuss! Was justice served here? 🤔

Do you think the legal system is too harsh on white-collar crimes like fraud? Should punishments be more severe or lenient?

Do you think the legal system is too lenient on white-collar criminals like Abubakar Musa? Should harsher penalties be imposed?

I wonder if theres more to this alleged fraud case than meets the eye. Seems like there could be a twist.

Do you think the court is being too harsh on Abubakar Musa for the alleged fraud? Or is justice being served? Lets discuss!

Is there more to this case than meets the eye? Curious about the complexities behind the alleged fraud. 🤔

Do you think the court decision was fair? Should there be stricter consequences for financial fraud like this? Lets discuss!