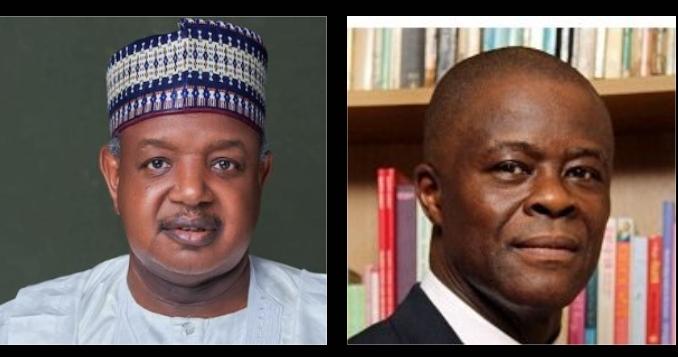

The Minister of Finance, Wale Edun, and the Minister of Budget and National Planning, Atiku Bagudu, have emphasized the necessity of increased borrowing to finance government policies. Despite a rise in revenue generation, the ministers noted that it remains insufficient for President Bola Tinubu’s administration to fund its projects, including infrastructure development.

The ministers shared these views during an interactive session with the Senate Joint Committees on Finance, National Planning, and Economic Affairs on the 2025-2027 Medium-Term Expenditure Framework and Fiscal Strategy Paper.

Coordinating Minister of the Economy, Wale Edun, acknowledged that while revenue efforts have improved, borrowing remains essential to sustain government initiatives. He stated, “The revenue effort has been good, but we still need to do better, and in the meantime, we still need to borrow productively, effectively, and sustainably. Not just infrastructure but also social services, health services, education, and intervention in terms of social safety nets to help the poorest and most vulnerable.”

Senator Atiku Bagudu explained that the borrowing plans embedded in the ₦35.5 trillion 2024 budget are primarily aimed at addressing the ₦9.7 trillion deficit. He elaborated, “Despite revenue targets surpassed by some of the revenue-generating agencies, the government still needs to borrow for proper funding of the budget, particularly in the area of deficit and productivity for the poorest and most vulnerable.”

Bagudu also pointed to Nigeria’s long-term developmental goals, referencing Agenda 2050, which aims to achieve a GDP per capita of $33,000. According to him, such an ambitious target necessitates strategic borrowing to ensure effective implementation of the government’s policies and programs.

While acknowledging the progress in revenue generation, the ministers’ statements highlight the financial challenges facing the current administration. They also underline the government’s commitment to addressing pressing social and economic issues, such as poverty alleviation, healthcare, education, and infrastructure development.

I dont buy it! Borrowing for government policies? Nah, we need better financial management, not more debt. Time for a rethink!

I dont buy it. Shouldnt we focus on reducing debt instead of relying on borrowing for government policies?

I dont buy it! We shouldnt burden future generations with debt for todays policies. Lets find alternative solutions.

Future generations will thank us for investing in their future now. Debt is a tool, not a burden.

I disagree! Governments should focus on sustainable funding, not just borrowing. Lets think long term, not just quick fixes.

I disagree! Borrowing can lead to debt traps and dependency. Lets find alternative ways to fund government policies. #DebtFreeNation

I disagree! Why burden future generations with debt when we can find alternative ways to fund government policies? Lets think long-term!

I disagree with Tinubu Ministers – borrowing too much can lead to debt crisis and harm the economy long-term.

I totally disagree with Tinubu Ministers! Borrowing for policies is not a necessity, its a dangerous precedent. Lets think long-term!

Borrowing for policies can drive growth if managed wisely. Short-term pain, long-term gain.

I dont buy it! Borrowing for government policies may be necessary, but arent there other ways to fund without getting into more debt?

I disagree! Borrowing for policies can lead to debt trap. We need fiscal discipline, not endless loans.

I strongly disagree with Tinubu Ministers on borrowing for government policies. Its a risky move with long-term consequences. Lets rethink our financial strategies!

I disagree! Borrowing for policies can lead to debt traps. We need sustainable solutions, not endless loans.

I strongly disagree with Tinubu Ministers! Borrowing for policies is risky, we should focus on sustainable solutions. Lets think long-term!

I totally disagree with Tinubus stance on borrowing for government policies. We need fiscal responsibility, not endless debt.

I respectfully disagree with Tinubu Ministers. Borrowing for policies may lead to debt issues in the future. Lets discuss!

Isnt borrowing just pushing the problem to future generations? Lets discuss alternative ways to fund government policies.

I disagree! Why burden future generations with debt? We need to find alternative ways to fund government policies.

I totally disagree with Tinubu and his ministers! Borrowing for policies is a slippery slope. Lets find better solutions.

I disagree with Tinubus Ministers. Borrowing for government policies may lead to debt dependency. We should prioritize sustainable financial strategies.

I believe borrowing for government policies can be a slippery slope. Lets think long-term consequences!